How to add payment gateway in website

Tips / 14.06.2021

The world of payments has certainly changed over the past few years, and it has changed quite quickly. When going shopping in the past, we’d use banknotes and coins to purchase items. Then came the cheque book, followed by credit and debit cards. Could things get more innovative than that? Actually, yes.

The technology that enables us to make payments on a POS terminal is referred to as a payment gateway. It communicates with the issuer bank and the merchant acquiring bank to ensure the transaction is secure, approved, and passes all the necessary criteria. However, with the rise of e-commerce, there’s been quite a revolution when it comes to payments acceptance online.

We shop online and expect the highest levels of security. But how can we be sure of this and how can small businesses prepare to go online? Let’s take a look.

What is a payment gateway?

An online payment gateway is the technology that enables consumers to make safe and secure payments via e-commerce websites. They are consumer-facing interfaces which collect payments from them and are also known as payment processing portals which have several functions and attributes including security, tokenisation, recurring payments, software integration and communication functionalities in addition to the MO/TO Virtual Terminal that enables you to accept card payments via email or telephone.

How payment gateway works

We break down the main steps in the purchasing process below – from the time the customer provides their card details to the payment actually arriving in the merchant’s account.

- The customer enters their card details online – this happens once they’ve chosen their product or service, and they’re taken to a secure page to enter their debit or credit card details.

- Encryption of card details – SSL encryption is used for the customer’s card details in order to send them safely from the client’s web browser to the merchant’s server. A payment gateway eliminates the merchant’s PCI DSS compliance obligations without redirecting customers away from your website.

- The merchant forwards transaction details – the recipient of this information is the SSL-encrypted payment gateway.

- Message conversion – the payment gateway converts the information sent from the merchant from XML to ISO 8583 (or a variant thereof) and forwards the information to the merchant acquiring bank’s payment processor.

- Transaction information is then forwarded to the card association – this can include Visa and Mastercard and the card issuing bank receives the authorisation request. It then confirms whether there are sufficient funds in the customer’s account and responds back to the processor with an “approved” or “declined” message.

- Authorisation is forwarded by the processor to the payment gateway – the payment gateway then forwards the response to the interface in order to process the payment. The general time frame for this is a matter of seconds.

- The order is fulfilled and the issuing bank moves funds from the customer to the merchant’s account – the merchant’s account is usually held by the merchant’s acquiring bank, although it can be a payment acceptance services provider, too.

- Fund settlement – depending on the merchant’s acquiring bank or financial services provider, funds are settled either in batches at the end of the working day or within two days or more or in the best case scenario – instantly.

So basically that is the process, and you already know what is payment gateway in e-commerce and why choosing the right one is important for your business growth.

An example of how payment gateway works is shown in the diagram below

Questions to ask yourself when looking for a payment gateway provider

When opting for a payment gateway provider, you need to make sure they cater to your needs in a holistic manner. Here are some questions you need to ask when doing your research:

- What are the most common types of payments used by your customers?

- Is there a fee for using the payment gateway and if so, what is it?

- How secure is the payment gateway’s encryption and do they work with PCI-compliance?

- What’s your chosen payment gateway’s reputation?

Some limitations of payment gateways

Not all payment gateways are the same and they certainly don’t offer you all you need for your business. With that being said, there are certainly some limitations to some payment gateways. Here are the most common ones:

- Their inability to accept all types of cards or payments

- Your international customers might not be able to pay you

- There might be some flaws in the security of your payment gateway provider.

How to set up online payment gateway

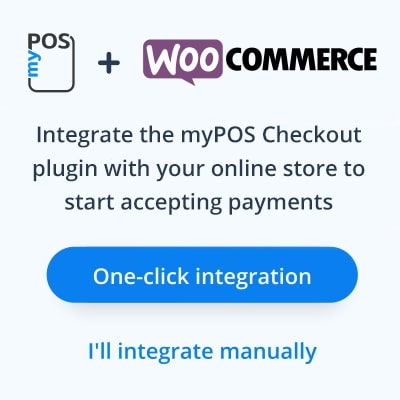

If you already run a successful online business, or you’re considering building one, we at myPOS have made integration with a payment gateway much easier and faster. You can now integrate the myPOS Checkout plugin with your WooCommerce online store in just one click and start accepting payments. All you need to do is link your myPOS account with WooCommerce, eliminating the need for lengthy manuals or even developers and making your payment gateway for small business that much more accessible.

How to integrate payment gateway in website?

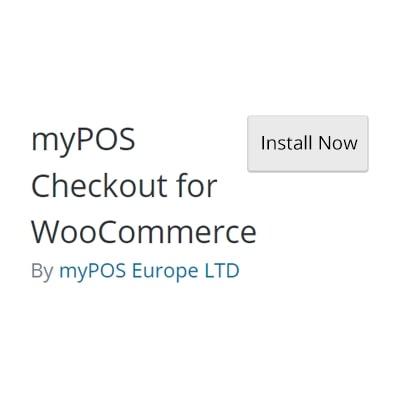

- Install the myPOS Checkout plugin for WooCommerce

![Step 1 of payment gateway integration]()

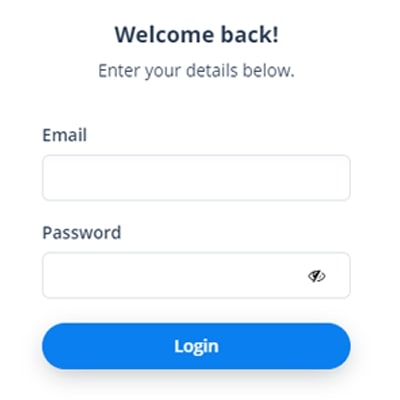

- Log in to your myPOS account

![Step 2 of payment gateway integration]()

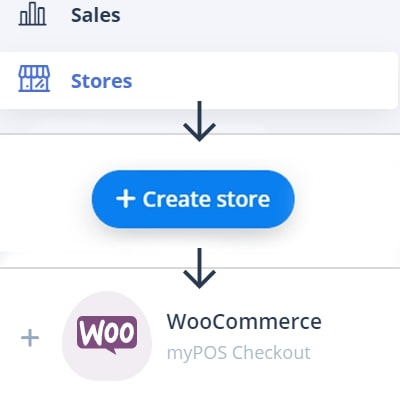

- Select Stores / Create new store / WooCommerce

![Step 3 of payment gateway integration]()

- Press One-Click integration

![Step 4 of payment gateway integration]()

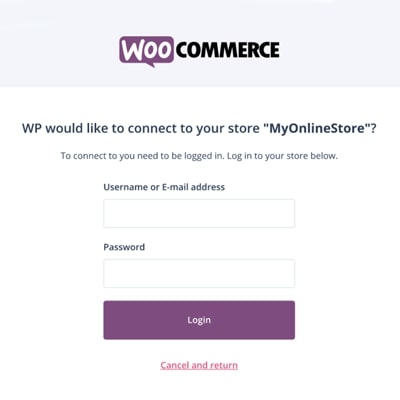

- Login and approve the access to your website

![Step 5 of payment gateway integration]()

Once done with the myPOS payment gateway integration, you can also customise your payments page to show off your brand.

Closing remarks

An online payment gateway is not only an excellent investment in your e-commerce business. It’s a necessity. You need to be able to offer your customers safe and secure ways to pay, in addition to offering them a variety of ways to pay you. The easier you make your checkout process, the less likely you are to have abandoned carts. While setting up a payment gateway may seem complicated, if you break it down into smaller parts, it’s actually quite manageable. And what’s more, one you set it up, you can start processing payments right away.